雖然地區當局管理著社會保險體系,但并非所有地區政府都制定了中國國際社會保障協議的實施規則。

China has signed social security agreements with 12 countries, but only 11 such agreements have been implemented. Currently, expatriates from Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia are eligible for social security exemptions across China.

中國已經與12個國家簽署了社會保障協議,但只有11個國家實施了此類協議。目前,來自德國、韓國、丹麥、加拿大、芬蘭、瑞士、荷蘭、西班牙、盧森堡、日本和塞爾維亞的外籍人士有資格在中國各地享受社會保障豁免。

In this article, we look at who is eligible for exemption and how to apply.

在這篇文章中,我們將探討誰有資格獲得豁免以及如何申請。

Social insurance in China

中國的社會保險

The Ministry of Human Resources and Social Security requires foreign employees working in China to participate in its social insurance scheme as detailed in the Interim Measures for the Participation in Social Insurance of Foreigners Employed in China, 2011.

人力資源和社會保障部要求在中國工作的外國雇員參加其社會保險計劃,詳見《2011年在中國就業的外國人參加社會保險暫行辦法》。

According to Chinese labor law, any foreigner employed by a legally registered entity in China or any foreigner dispatched to a registered branch or representative office of a foreign company – must participate in basic pension insurance for employees, basic medical insurance for employees, work injury insurance, unemployment insurance, and maternity insurance.

根據中國勞動法,任何受雇于在中國合法注冊的實體的外國人,或任何被派遣到外國公司注冊分公司或代表處的外國人,都必須參加員工基本養老保險、員工基本醫療保險、工傷保險、失業保險和生育保險。

However, since social insurance is managed at a regional level, a range of inconsistencies exist among cities. As a result, most major cities have implemented their respective requirements for foreign employees.

然而,由于社會保險是在地區一級管理的,因此城市之間存在一系列不一致之處。因此,大多數大城市都實施了各自對外籍員工的要求。

For example, in cities such as Beijing, Tianjin, Shenzhen, and Nanjing, among many others, social insurance payments are compulsory for foreign employees – who are treated in the same way as domestic workers. On the other hand, Shanghai does not currently require foreign employees to contribute towards social insurance.

例如,在北京、天津、深圳和南京等城市,外籍員工必須繳納社會保險,他們的待遇與家政工人相同。另一方面,上海目前不要求外籍員工繳納社會保險。

Since all regional authorities have not implemented rules in accordance with international social security agreements – which increases the difficulty in obtaining exemptions – employees from countries that have agreements with China are eligible for social insurance exemptions.

由于所有地區當局都沒有根據國際社會保障協議實施規則,這增加了獲得豁免的難度,因此來自與中國有協議的國家的員工有資格獲得社會保險豁免。

To date, 11 such agreements have been implemented between China, and the following countries: Germany, Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia.

迄今為止,中國與以下國家已經實施了11項此類協議:德國、韓國、丹麥、加拿大、芬蘭、瑞士、荷蘭、西班牙、盧森堡、日本和塞爾維亞。

China has also signed agreements with France and Serbia; these agreements are not yet in effect.

中國還與法國和塞爾維亞簽署了協議;這些協議尚未生效。

Applicable countries

適用國家/地區

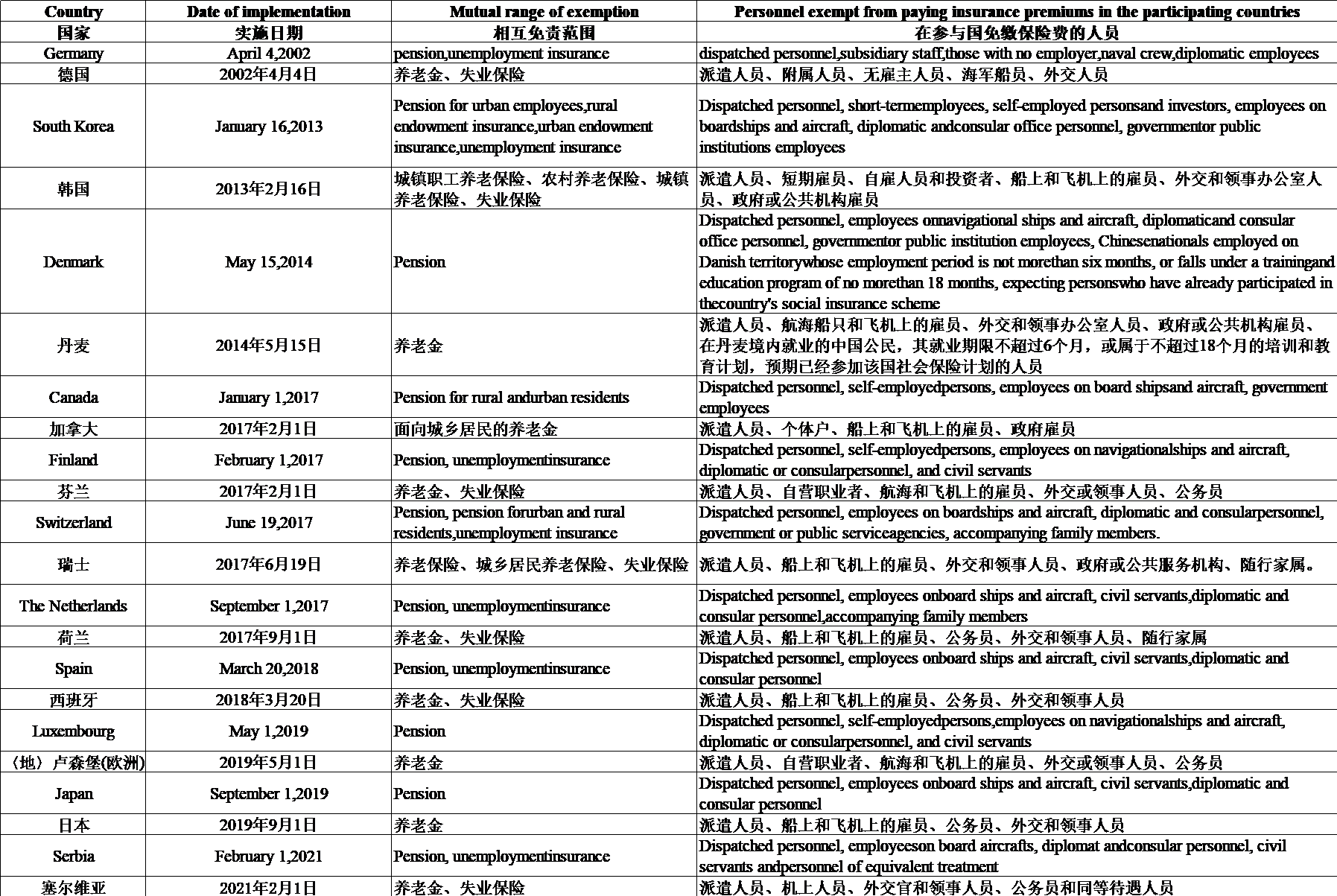

All existing agreements define the groups of employees eligible for exemption and lay out the categories of social insurance for which employees are exempt from paying.

所有現有協議都定義了有資格獲得豁免的員工群體,并規定了員工免于支付的社會保險類別。

In turn, Chinese employees sent to the participating country will also be exempt from making the relevant social insurance contributions there.

反過來,被派往參與國的中國雇員也將免于在那里繳納相關的社會保險費。

Social insurance exemptions are only available to a defined group of labor categories, and not to all foreign employees.

社會保險豁免僅適用于特定的一組勞動類別,而不適用于所有外國雇員。

The 11 bilateral agreements with China for social insurance payment exemptions that have been implemented are shown in the table below.

已實施的與中國的11項社會保險支付豁免雙邊協議如下表所示。

For example, the China-Japan social insurance agreement, which took effect September 1, 2019, will exempt Japanese nationals from China’s basic pension contribution as well as exempt Chinese nationals from Japan’s National Pension and Employees’ Pension Insurance.

例如,2019年9月1日生效的《中日社會保險協定》將免除日本國民的基本養老金繳款,并免除中國國民的國民養老金和雇員養老保險。

It will apply to dispatched personnel, employees on board ships and aircraft, civil servants, and diplomatic and consular personnel of each side.

它將適用于派遣人員、船上和飛機上的雇員、公務員以及雙方的外交和領事人員。

As to the agreement with France, which is not yet effective, details including the implementation date and range of exemptions will be announced – once each country completes their respective domestic legal procedures.

至于尚未生效的與法國的協議,一旦每個國家完成各自的國內法律程序,將公布包括實施日期和豁免范圍在內的細節。

Basic process for applying for premium exemptions

申請保費豁免的基本流程

Exemption does not apply automatically, and companies with foreign employees are required to apply to related bureaus for exemption.

豁免并不自動適用,擁有外國員工的公司需要向相關局申請豁免。

Though the process of applying for insurance premium exemptions varies across regions, and according to the specific agreement under which it is performed, it follows a standard formula.

盡管申請保險費豁免的過程因地區而異,但根據具體的協議,它遵循一個標準公式。

The entity that employs the foreign employee in China must submit original certification of insurance issued by a relevant entity in the country of origin to the local Chinese social insurance bureau.

在中國雇用外國雇員的單位必須向當地中國社會保險局提交原籍國相關單位出具的保險證明原件。

This will then be verified, and a copy will be held on record. Following verification of this documentation, and possible further verification and certification, the employee in question will be exempt from the relevant social insurance payments.

然后將對此進行驗證,并將一份副本記錄在案。在對該文件進行驗證以及可能的進一步驗證和認證后,相關員工將免于繳納相關社會保險。

The time limit of the exemption period may vary.

豁免期的期限可能會有所不同。

For employees from the Netherlands, for example, the maximum length of the exemption period is five years. If the dispatch period is more than five years, the time limit for exemption will not be extended for more than one year.

例如,對于來自荷蘭的員工,豁免期最長為五年。如果派遣期限超過五年,豁免期限將不會延長超過一年。

Difficulties of implementation

實施難度

While social insurance exemption agreements offer cost benefits to enterprises based in China, businesses should act in caution regarding how they go about availing them.

雖然社會保險豁免協議為中國企業提供成本效益,但企業在如何利用這些協議時應謹慎行事。

Although bilateral agreements for exemption are made at a national level, regional governments must implement the system locally.

盡管雙邊豁免協議是在國家層面制定的,但地區政府必須在當地實施該制度。

This invariably results in inconsistencies and varying levels of implementation at a local level, complicating the process for companies and foreign employees.

這必然導致地方一級的執行不一致和程度不同,使公司和外國員工的流程復雜化。

David Niu, Senior Manager of Human Resources Administration and Payroll Services at Dezan Shira Associates, explains: “Officers in social insurance bureaus are often unsure about how to implement foreign employee social insurance exemptions. Many cities have no local regulations relating to this topic, especially in second and third-tier cities.”

協力商業顧問公司人力資源管理和工資服務高級經理David Niu解釋道:“社會保險局的官員通常不確定如何實施外籍員工社會保險豁免。許多城市沒有與此相關的地方法規,尤其是在二三線城市。”

He elaborates: “Cases exist where city-level regulation for insurance exemption is not at hand from the local bureau. In such cases, if a business makes the decision not to make social insurance payments for their foreign staff, they may be challenged by the bureau for non-compliance during a later insurance inspection.”

他詳細闡述道:“在一些情況下,地方局沒有制定市級的保險豁免規定。在這種情況下,如果企業決定不為其外籍員工支付社會保險,他們可能會在隨后的保險檢查中因不遵守規定而受到局方的質疑。”

David also highlights a key grievance that emerges in this area in the case of Shanghai.

戴維還以上海為例,強調了在這一領域出現的一個關鍵的不滿。

“By local rule, female foreign employees are not required to contribute to maternity insurance in Shanghai, which can cause some disagreement between the employer and the employee. In case the foreign female staff needs to take maternity leave, the local social insurance bureau will not cover the payroll and relevant costs for the staff during the leave.”

"根據當地規定,女性外籍員工不需要在上海繳納生育保險,這會引起雇主和雇員之間的一些分歧。如果外籍女性員工需要休產假,當地社保局將不為員工支付產假期間的工資和相關費用。

“However, from the employer’s perspective, they seem to have no legal obligation to compensate the cost themselves either. Thus, the employer should reach an agreement prior to employing the staff to define the future obligations and responsibilities to avoid labor disputes on this issue.”

然而,從雇主的角度來看,他們似乎也沒有法律義務補償自己的成本。因此,雇主應在雇傭員工之前達成一致意見,以確定未來的義務和責任,避免在這個問題上發生勞動爭議。

Finally, companies should note that failure to pay social insurance premiums when not in receipt of explicit consent from the local social insurance bureau bears an inherent risk.

最后,企業應注意在未得到當地社會保險局明確同意的情況下不繳納社會保險費的行為具有內在風險。

Therefore, it is essential to consult both the local social insurance bureau, as well as relevant staff at the local labor bureau before taking any unilateral measures.

因此,在采取任何單邊措施之前,既要咨詢當地社會保險局,也要咨詢當地勞動局的相關工作人員。

Additionally, seeking the help of an advisor is highly recommended. If appropriate precautions are taken, these agreements can be beneficial tools for enterprises employing foreign staff in China.

此外,強烈建議尋求顧問的幫助。如果采取適當的預防措施,這些協議可以成為在中國雇用外籍員工的企業的有益工具。

責任編輯: